Free Financial Tools for Financial Planning

Try some of our free, useful financial tools that we have provided for your convenience. All tools are free to use on our website. These tools can also be purchased and downloaded in Microsoft Excel. Most tools only cost $6 to download. Tools will be emailed to you after purchase is complete. Butler Consultants does not provide support for these free tools.

Select a Tool:

- Free Financial Statement Template

- Loan Amortization Tool

- Free Loan Amortization Tool w/ Addl. Payments

- Free Compounding Interest Calculator Tool

- Free Debt Repayment Calculator Tool

- Free Business Valuation Tool

- Free Balance Sheet Ratios Tool

- Free Return On Tool

- Front and Back Mortgage Ratios Tool

- Free Certificate of Deposit (CD) Calculator

- Free Vehicle Lease or Buy Calculator

- Free IRR Internal Rate of Return Calculator Tool

- How Much Home Can I Afford Free Tool

Free Financial Statement Template Tool

The financial statements template tool is designed to work as an internal document for organizations. This tool creates an Income Statements, Statements of Cash Flow, and a Loan Amortization Schedule. There are 8 main areas the user can change to create their financial statements: Revenue, Expenses, Tax Rate, Depreciation, Loan, Investment, Assets Purchased, and Assets Sold.

Click here to use this tool: Financial Statement Template Tool

Free Loan Amortization Schedule Tool

The loan amortization schedule details each loan payment on a loan. Amortization schedules are used to build financial statements. This tool allows the user to simply input the loan amount, loan interest rate and loan term. The output will break down the month, balance, interest, principle, and payment.

Click here to use this tool: Loan Amortization Schedule Tool

Free Loan Amortization Schedule Tool With Additional Payments

The loan amortization schedule details each loan payment on a loan. This tool will allow the user to add additional payments each month to pay off the loan sooner. This tool allows the user to simply input the loan amount, loan interest rate and loan term. The output will break down the month, balance, interest, principle, and payment.

Click here to use this tool: Loan Amortization Schedule Tool 2

Free Compounding Interest Calculator Tool

The compounding interest calculator shows how much can be saved by compounding savings overtime. An amortization schedule can be seen after you have calculated the savings. This tool provides a monthly breakdown of the funds accumulating overtime.

Click here to use this tool: Compounding Interest Calculator Tool

Free Debt Repayment Calculator Tool

The debt repayment calculator details how many months it will take to be debt free, total amount paid (includes total debt and interest) and total interest. This tool creates a visual representation of how much money is saved and how much sooner you can be debt free. This tool can be used for home loans, credit cards, and any other periodic payment loans.

Free Business Valuation Tool

The business valuation tool provides detailed information on investor return based on a 5 year investment. The tool can be used to make an estimate of the economic value of the investor’s interest in a business. This tool can be used to calculate multiple injections of funds. Contact Butler Consultants for a more detailed business valuation.

Free Balance Sheet Ratios Tool

The balance sheet ratios tool includes a quick ratio and a current ratio. These ratios are very useful in determining the financial strength of an organization. Both ratios are an indicator of an organization’s short-term liquidity and measures the company’s ability to pay short-term debt.

Free Return On Ratios Tool

The return on ratios tool provides the user with three different ratios: return on assets (ROA), return on sales (ROS), and return on equity (ROE).

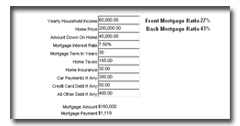

Front and Back Mortgage Ratios Tool

Mortgage ratios are important for the mortgage approval process. Mortgage ratios come second only to your credit report as the most important factor an underwriter will consider when reviewing a loan application. Mortgage ratios are frequently referred to as Front and Back Mortgage Ratios and are expressed as “24/32”.

Certificate of Deposit (CD) Calculator

This calculator is designed to help determine the potential interest growth on your Certificate of Deposit. This tool will also work for other investments with distributed interest payments.

Click here to use this tool: Certificate of Deposit (CD) Calculator

Vehicle Lease or Buy Calculator

This tool allows the user to determine if buying a vehicle or leasing it is the best option.

Click here to use this tool: Vehicle Lease or Buy Calculator

IRR Internal Rate of Return Calculator Tool

This tool allows the user to measure the IRR of 3 separate projects. The internal rate of return (IRR) is a capital budgeting metric used by people to decide whether they should make an investment in the project. It is an indicator of the efficiency or quality of an investment.

Click here to use this tool: IRR Internal Rate of Return Calculator Tool

How Much Home Can I Afford Calculator

This tool allows you to find out what amount could be borrowed for a home.

Click here to use this tool: How Much Home Can I Afford Calculator